Bidenomics, AI money, problems for bankers

Recent fun news

This week, the White House unveiled a new push for “Bidenomics” (press memo). In Philadelphia a few weeks ago, President Biden apparently said he does not know “what the hell it is.” From the memo, it mentions jobs, middle class, infrastructure, and it keeps saying it is working?

More money for chips and NVIDIA. Money continues to flow to generative AI startups making foundational models. MosaicML exited for $1.3B to Databricks. Inflection AI announced finishing a $1.3B round of funding, valuing at $4B.

Cumulative funding raised by foundational model startups:

- OpenAI $11.3B

- Inflection AI $1.525B

- Anthropic $1.5B

- Cohere $445M

- Adept $415M

- Runway $237M

- Character.ai $150M

- Stability AI $100M

Orcas have been intentionally ramming into ships on the ocean. The behavior has spread from the seas around the Iberian peninsula to the North Sea between Scotland and Norway, almost 2,000 miles away. Many theories, no answers.

Wall Street continues to downsize. Goldman Sachs cuts 125 Managing Directorsglobally. JPMorgan cuts 40 dealmakersin North America. The Swiss bank UBS plans to cut 30,000 jobs this year.

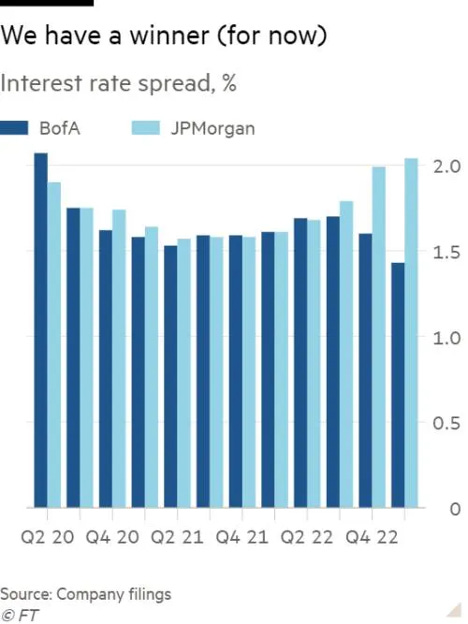

Move aside Silicon Valley Bank, FDIC data shows Bank of America’s ~$100B in paper losses from its bond investments made during the pandemic-driven deposit increase. By comparison, SVB had a ~$16B loss in its held-to-maturity portfolio. Bank of America’s bet on securities is leading it to trail its leading competitor (see number 7 in Speed Read), JPMorgan—who decided to sit on its pandemic cash instead.

Thanks for reading Myriad Perspectives! Subscribe for free to receive new posts and support my work.

Subscribed

This week’s Speed Read

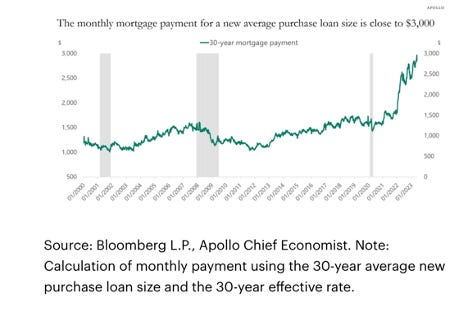

1. The monthly mortgage payment for a new average purchase loan size is close to $3,000, nearly 2x from ~$1,000 to ~$1,500 range from 2000 to 2019.

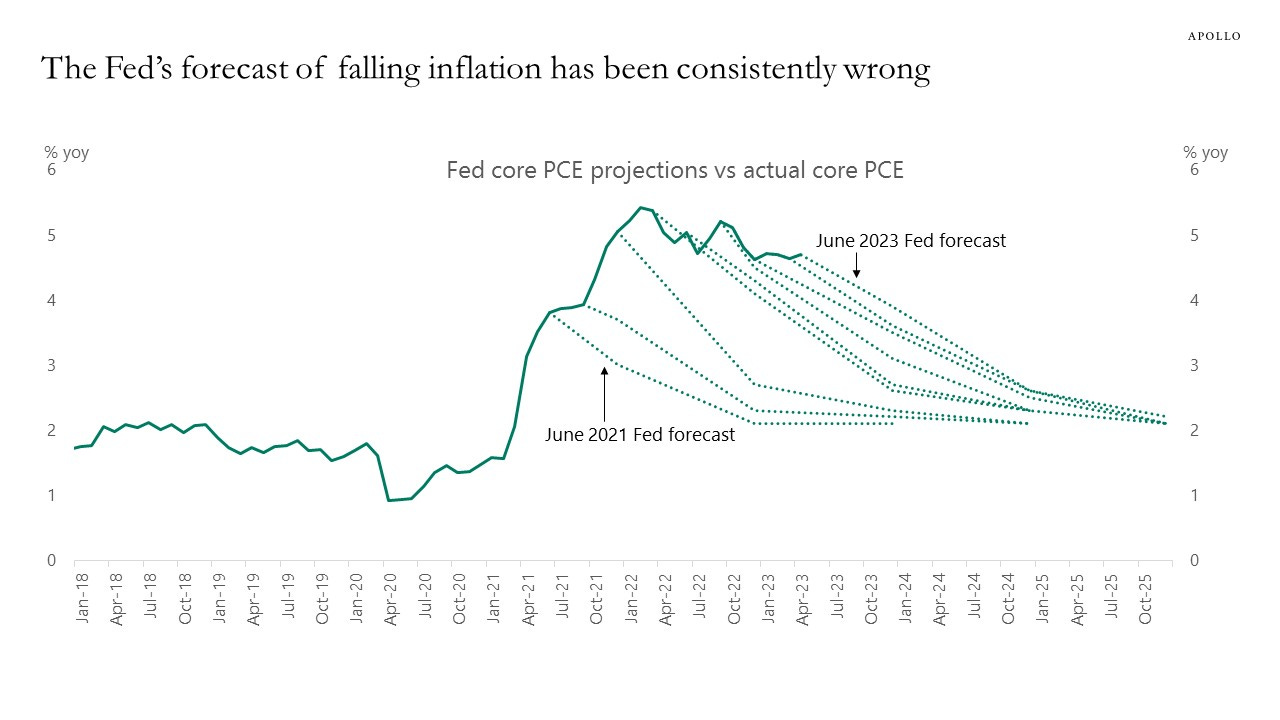

2. Every single inflation forecast from the Federal Reserve since June 2021 has been wrong.

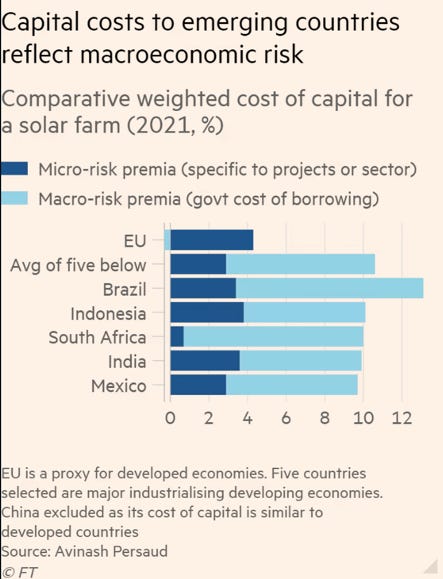

3. In emerging countries (i.e. Brazil, India, Mexico), the cost of capital to build renewable energy infrastructure (i.e. a solar far) is ~2x higher than developed countries—EU’s ~4% cost of capital vs. India’s ~10% cost of capital.

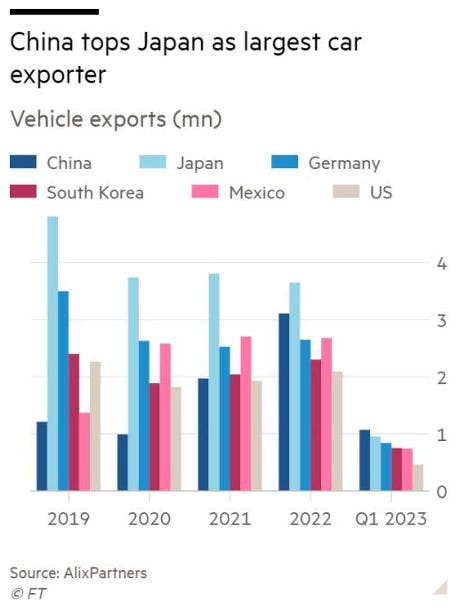

4. For the first time, in Q1 2023, China topped Japan to be world’s largest exported of automobiles.

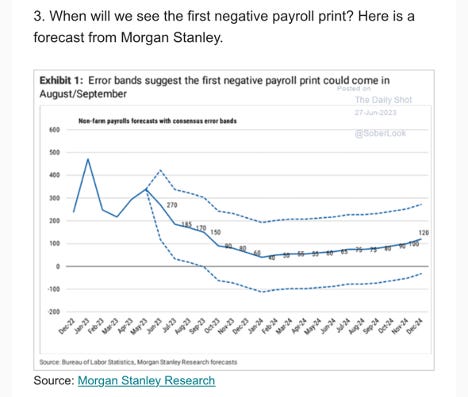

5. Morgan Stanley thinks the US will see its first negative payroll month around the end of this summer (August/September).

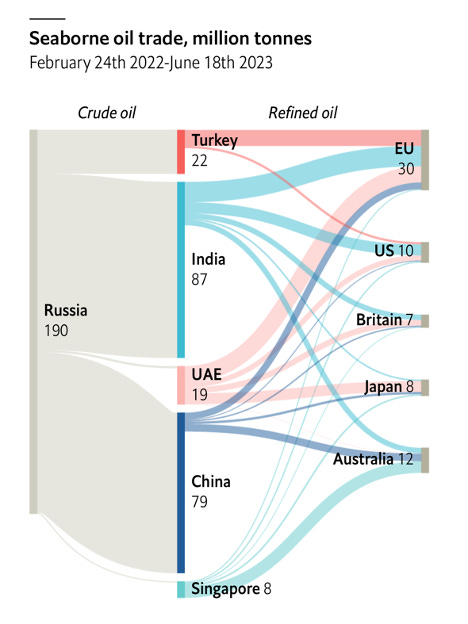

6. Since the start of the Ukraine war, ~25% of Russia’s crude oil continued flow to Western countries in the EU, the US, and the UK, through the conduits of Turkey, India, UAE, and China

7. In Q1 2023, Bank of America’s net interest rate spread (the difference between the interest rate it earns from its loans and assets, and the interest rate it pays to depositors) was 1.43% compared to JPMorgan’s 2.04% (42% higher).

Speed Read Charts

This week’s fun fact

France has laid the most undersea cables, closely followed by the United States.

Each of these countries have laid more than 500 thousand kilometers of cables, more than 1.3x the distance from Earth to the Moon.