BJ’s Wholesale Club favored new gas stations in 2022

In 2020, BJ’s Wholesale announced a long-term capital strategy to re-invest in unit store growth, moving from zero net openings to ~3-4% annual unit growth. At the same time, BJ’s announced increasing the number of gas stations to match unit store growth and increasing the number of gas stations to be ~75% of warehouse clubs (~70% today).

As a result, in 2022, BJ’s gas station unit growth grew to ~8% per annum. For FY23, BJ guided to $350 million in capital expenditures. If we assume $125 million to be maintenance capex, then $225 million would be spent on new warehouse clubs and gas stations.

Over the same period, BJ’s earned $18.7 billion in revenues. Gasoline sales contributions were $3.8 billion or 20% of revenues.

Comparably, BJ’s is a much smaller retailer than its peers’ parent companies. Walmart (owner of Sam’s Club) and Costco are the 1st and 3rd largest retailers in the US. At the end of 2022, BJ’s operated 233 clubs and 163 gas stations (attached to clubs) across 18 states in the eastern United States. In terms of real estate, it is a regional leader in number of clubs within New England, with ~2x the number of Costco and Sam’s Club locations combined.

Warehouse clubs, like BJ’s, predominantly rely on members driving their personal vehicles to the nearest club. In addition, most warehouse clubs increasingly relied on onsite gas stations to generate foot traffic into warehouse clubs. For BJ’s, only a third of gas station customers shopped in the warehouse club within the same trip.

Compared to traditional supermarkets, the warehouse club model places clubs in areas further away from residential centers to benefit from lower real estate operating costs. As a result, a member’s distance to a warehouse club is ~12x longer compared to distance to a member’s closest supermarket.

The warehouse club model is disproportionately more reliant on personal vehicle transportation and gasoline sales. These dependencies create transition risks for the warehouse club retail model, not to mention the related scope 3 emissions from personal vehicle transportation.

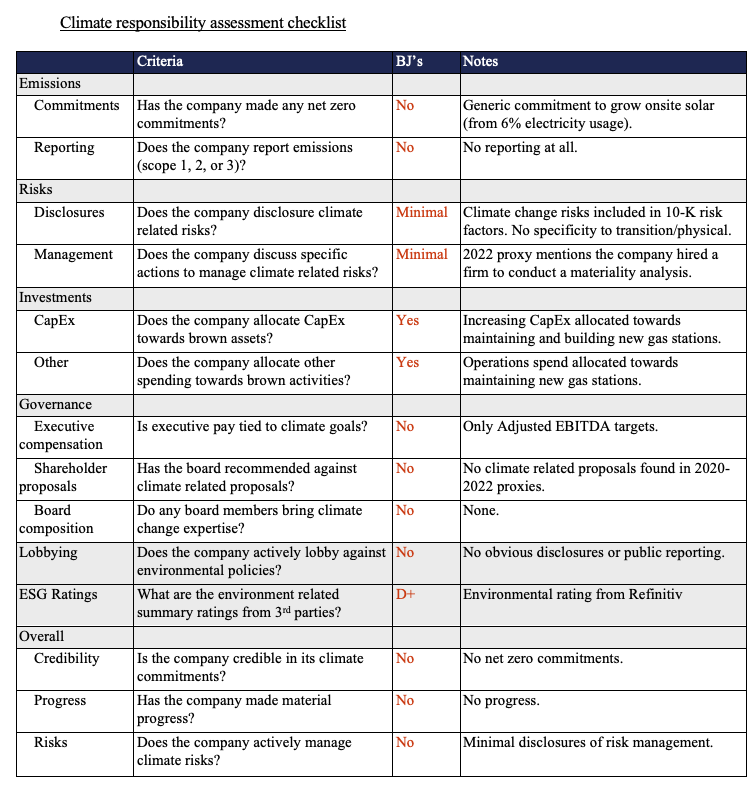

Yet as of today, BJ’s has no public plans to report GHG emissions or signal any emissions commitments.