Renting clothes in Japan, "Speak Now", and Jobs

Recent fun news

Save on baggage, rent clothes when visiting Japan, says Japan Airlines (JAL). Travelers visiting Japan via JAL are being offered a new service called “Any Wear, Anywhere” to ditch their heavy baggage and pack lighter. Through the service, you can rent six tops and three bottoms for 6,000 yen, or about $45, for two weeks. The airline believes this experiment can reduce luggage weight per flight, leading to less fuel use.

“Speak Now”: Taylor Swift continues to re-record her old albums, releasing the latest version on July 7, 2023. Ms. Swift has since re-recorded 3 out of the first 6 of her albums. Shamrock Holdings—a private equity firm owned by the estate of Roy E. Disney—bought the rights to those albums for $300M in 2020. Perhaps unsurprisingly, each release of a re-recorded album lifts Taylor’s entire catalog in the streaming charts (original and re-recorded). As music right holders are paid by streaming counts, each releases provide a large injection of music sales for both Ms. Taylor and Shamrock Holdings.

Jobs report: U.S. job creation in June was 209,000, falling short of the projected 225,000. This marks the first time in 14 months that actual numbers feel short of consensus, according to Bespoke Research.

Pension funds start unloading private equity assets. The New York State Teacher’s Retirement system is looking to unload $6 billion of assets into the secondary market. Private equity funds are usually close-ended for 8-10 years, these movements in secondaries suggest the smart money wants to take profits while the marks are still frothy.

This week’s Speed Read

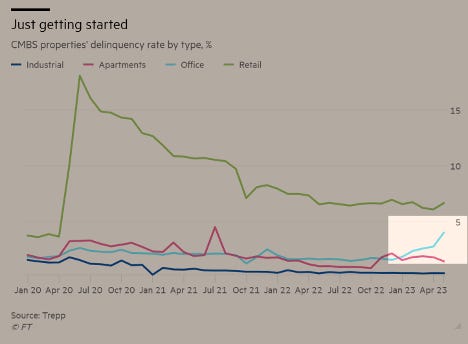

1. Some updates on office commercial real estate (CRE): Office commercial properties are started an upward trend towards high delinquencies since Jan 2023, from ~2% to ~4%.

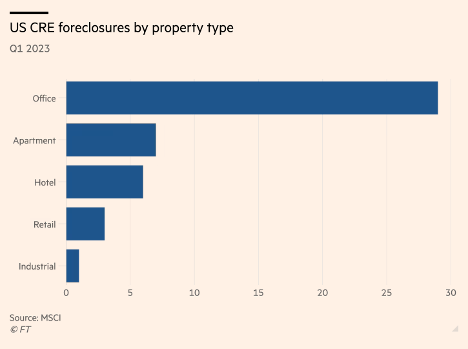

2. In Q1 2023, offices dominated CRE foreclosures (~63% of all CRE foreclosures).

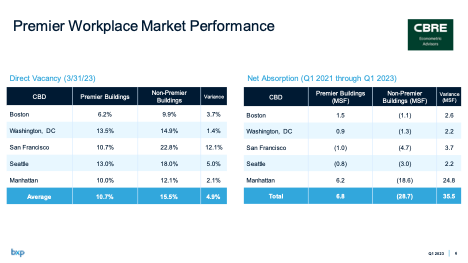

3. Higher quality office spaces fare substantially better, many metros (Boston, D.C., Manhattan) even continuing to see positive net absorption (incremental occupied squared footage) since 2021.

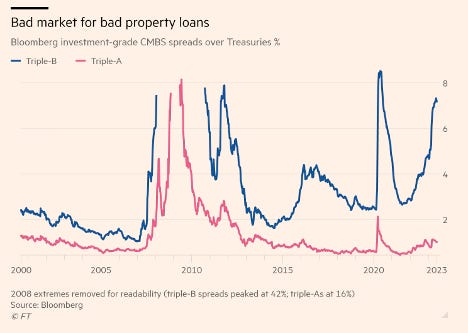

4. CMBS (commercial mortgage-backed securities) market also signals similar discontinuities through bond spreads between b/w higher credit rating (Triple-A) vs. lower credit rating (Triple-B) bonds. The spread is ~6%, which is nearing March 2020 pandemic levels.

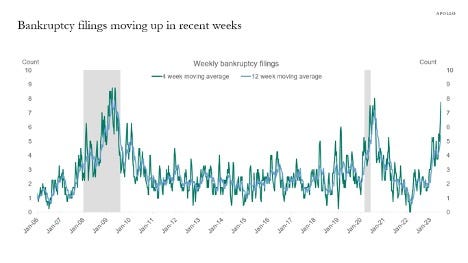

5. Weekly bankruptcy filings moving back up to near GFC (2008 global financial crisis) and March 2020 (pandemic) levels.

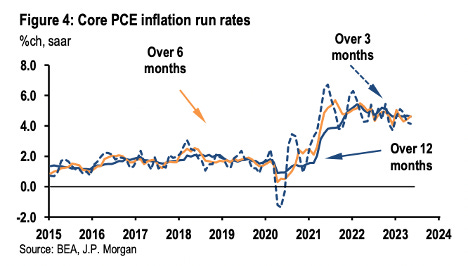

6. Inflation stubbornly not going away, with core PCE around ~4%.

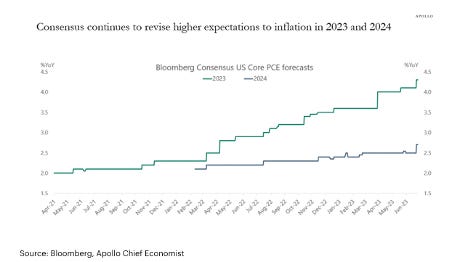

7. Wall Street continues to revise to higher inflation expectations in 2023 and 2024. 2023 consensus estimate at ~4.4%.

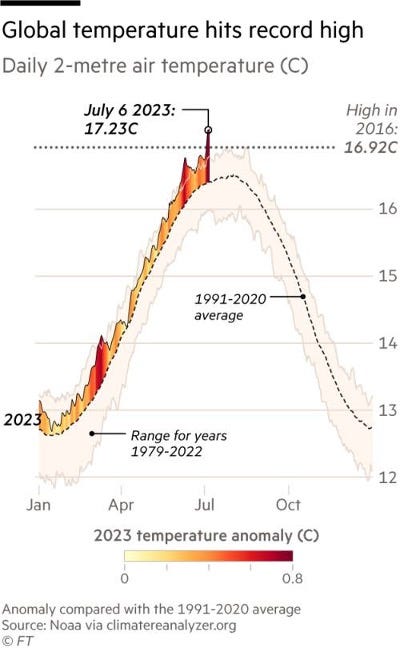

8. Global temperatures hit another record high on July 6, 2023, 17.23 Celsius.

Speed Read Charts

This week’s fun fact

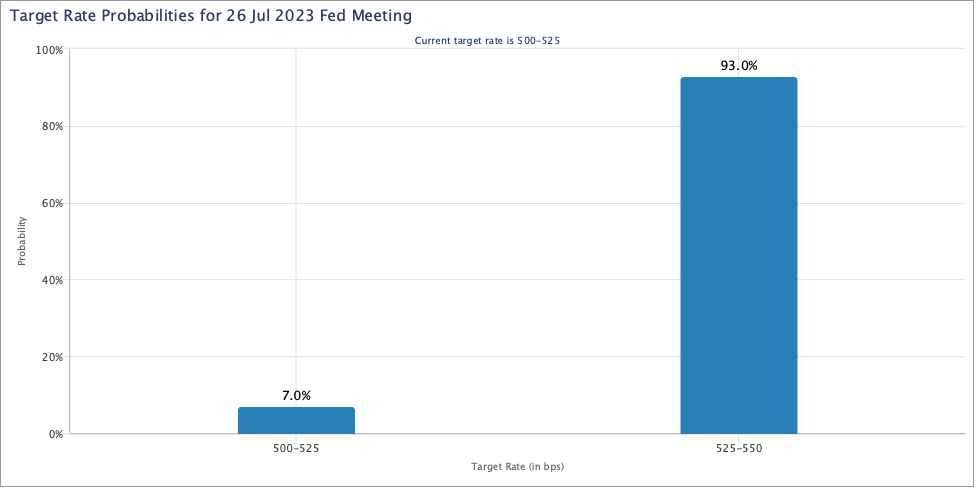

On May 4, 2023, the Federal Reserve’s FOMC (federal open markets committee) increased the federal funds rate by 25 basis points to 5.00% to 5.25%.

As of Jul 9, 2023, the market has priced in a 93% probability that the committee will raise the range another 25 basis points at the Jul 26, 2023 meeting.